Last month, Brett Adcock, founder of robotics startup Figure AI, claimed in a post on X that his company had become the most sought-after private stock in the secondary market. However, Figure AI has recently sent cease-and-desist letters to at least two brokers running secondary marketplaces, as confirmed by sources speaking to TechCrunch. The letters demanded these brokers cease marketing and facilitating the sale of Figure AI’s stock.

According to the brokers who received the letters, the cease-and-desist orders came after Bloomberg reported in mid-February that Figure AI was seeking to raise a $1.5 billion funding round at a $39.5 billion valuation, a remarkable increase from its valuation of $2.6 billion in February 2024.

A spokesperson for Figure AI explained that the company issues these cease-and-desist letters when it discovers that brokers are marketing its shares without authorization. This is a standard practice for the company, which has done so in the past with other brokers. The company further clarified that it does not allow secondary market trading of its stock without the approval of its Board of Directors and will continue to protect itself from unauthorized third-party brokers.

As a private company, Figure AI’s stock is not freely tradable like that of public companies. Investors cannot sell shares without specific company authorization, leading to the rise of secondary markets that provide alternative ways for shareholders to liquidate their holdings. These markets offer options such as loans secured by shares, which become repayable when the company goes public.

However, brokers involved in the secondary markets speculate that some CEOs, including those at Figure AI, dislike secondary market sales for another reason. They believe that existing shareholders are attempting to sell their shares at lower prices than the company’s expected new valuation, which could undercut the valuation of the company’s upcoming funding round.

Sim Desai, CEO of Hiive, a secondary marketplace for shares, commented on this phenomenon, noting that companies sometimes block secondary market transactions because they view them as a “zero-sum game” — believing that a lower secondary market price could reduce demand for the new round of funding. Desai argued that in some cases, secondary market activity might actually increase interest in primary shares.

Despite this, if secondary market transactions fail to generate interest in the new round, it could signal a deeper issue with the company’s valuation. As Desai noted, “If someone is having a hard time selling something, it’s merely a function of price and valuation rather than availability of capital.”

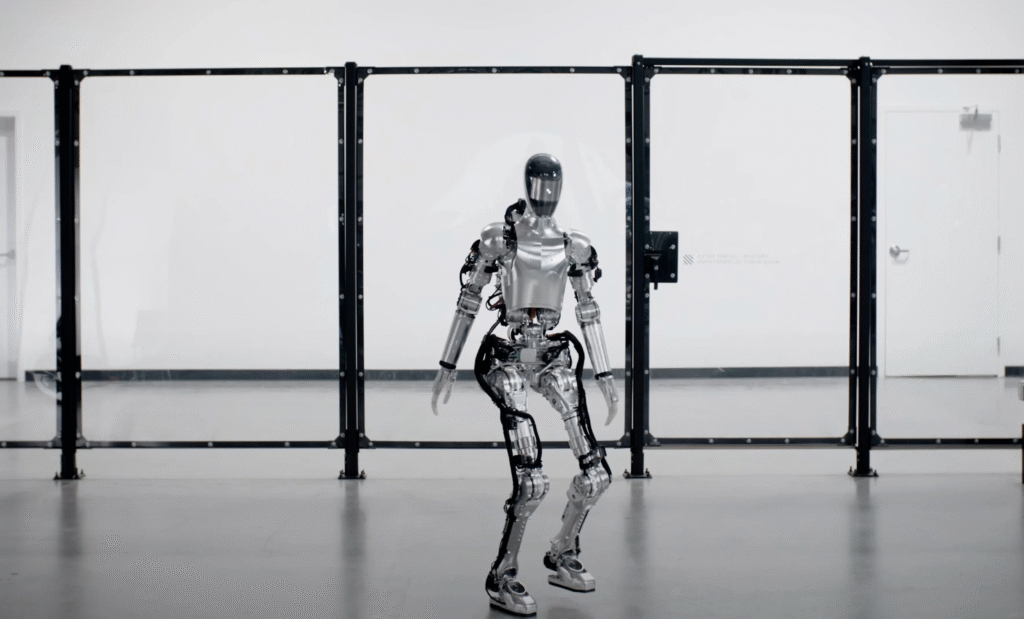

In addition to these secondary market concerns, Figure AI has recently faced criticism over its partnership with BMW, which has been highlighted in several news articles. In response, the company has threatened legal action, citing inaccuracies in the coverage.

As for Figure AI’s next fundraising round and its valuation, it remains to be seen how much the company will raise and what impact secondary market activity will have on its fundraising efforts. Whether investors will be able to cash out early in secondary transactions also remains uncertain.

Also Read : Meet the companies racing to build quantum chips