Usually, when we think of venture capitalists (VCs), we imagine them pouring money into fresh startups aiming to shake up industries or invent entirely new ones. But lately, some VCs are trying something a bit different.

Instead of just backing new companies, they’re buying mature businesses — things like call centers, accounting firms, and other professional service companies — and then using artificial intelligence to make these companies run smarter and serve more customers through automation.

This approach is kind of like what private equity firms do with roll-ups, but with a high-tech twist. Big-name VCs like General Catalyst, Thrive Capital, and even solo investor Elad Gil have started jumping on this trend. For example, General Catalyst has backed seven of these AI-optimized companies, including Long Lake, a startup that’s buying up homeowners associations to simplify community management. And in less than two years, Long Lake has raised a whopping $670 million.

Though it’s still a fresh idea, other VC firms have told TechCrunch they’re considering trying this approach too.

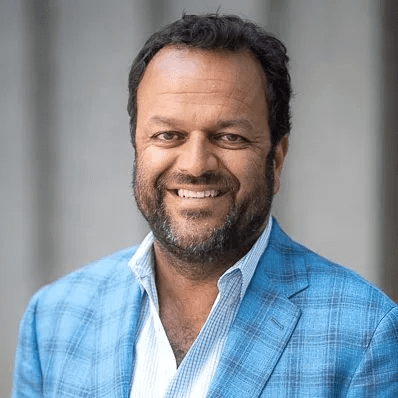

One of them is Khosla Ventures, a firm famous for taking early bets on bold, cutting-edge tech that might take years to pay off.

Samir Kaul, a general partner at Khosla, told TechCrunch, “We’re definitely looking at a few of these opportunities.”

What’s interesting is how this strategy might actually help AI startups. By combining older, established businesses with new AI tech, these startups could instantly tap into large, existing customer bases — something that’s usually tough for new companies to do.

Kaul explained this is especially important because AI startups often struggle to find customers on their own. The AI space is moving fast, lots of new startups are popping up, and selling to big companies usually takes a long time. So having established businesses in the mix could be a real game changer.

That said, Khosla Ventures is approaching this carefully. Kaul said, “The companies we’re looking at are very unlikely to lose money.” Still, he’s cautious because managing other people’s money is a big responsibility, and he wants to keep delivering strong returns.

Right now, Khosla is “dabbling” in these AI roll-up deals — trying a few to see how well they perform before possibly raising a dedicated fund just for this strategy.

Also Read : From Pop Star to Startup Founder: How Kesha Is Empowering Music Creators